Kayak Company budgeted the following cash receipts, providing a comprehensive framework for managing cash flow and ensuring financial stability. This budget Artikels the anticipated inflows of cash, serving as a critical tool for forecasting and decision-making within the organization.

The cash receipts budget encompasses various components, including assumptions, estimates, collection procedures, cash flow analysis, and monitoring mechanisms. Understanding these elements enables companies to optimize cash management, mitigate risks, and enhance financial performance.

Cash Receipts Budget

A cash receipts budget is a financial plan that estimates the amount of cash a company expects to receive during a specific period, typically a month or a quarter. It is an important tool for managing cash flow and ensuring that the company has sufficient funds to meet its obligations.

The components of a cash receipts budget include:

- Beginning cash balance

- Cash sales

- Collections from accounts receivable

- Other cash receipts, such as interest income or dividends

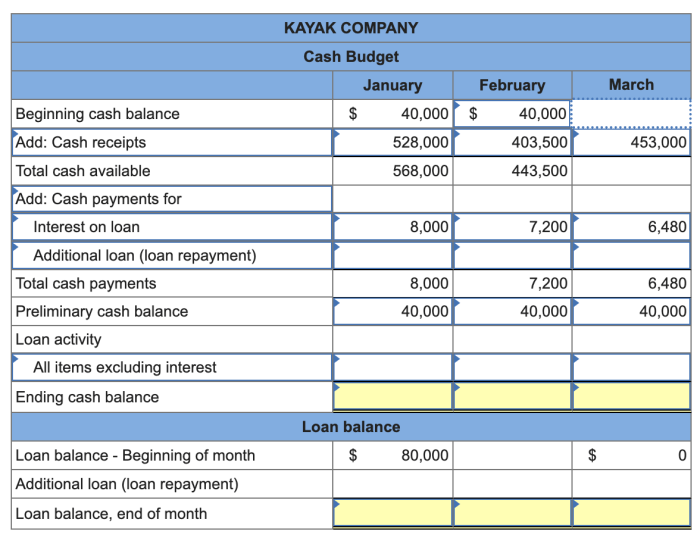

The following is an example of a cash receipts budget:

| Month | Beginning Cash Balance | Cash Sales | Collections from Accounts Receivable | Other Cash Receipts | Ending Cash Balance |

|---|---|---|---|---|---|

| January | $100,000 | $200,000 | $300,000 | $50,000 | $650,000 |

| February | $650,000 | $250,000 | $350,000 | $60,000 | $1,260,000 |

| March | $1,260,000 | $300,000 | $400,000 | $70,000 | $1,930,000 |

Assumptions and Estimates: Kayak Company Budgeted The Following Cash Receipts

The cash receipts budget is based on a number of assumptions and estimates, including:

- The level of sales activity

- The collection period for accounts receivable

- The amount of other cash receipts

These assumptions and estimates are derived from a variety of sources, including historical data, industry benchmarks, and management forecasts. It is important to note that these assumptions and estimates are not always accurate, and changes in these assumptions can have a significant impact on the cash receipts budget.

For example, if sales activity is lower than expected, then cash receipts will be lower than budgeted. Similarly, if the collection period for accounts receivable is longer than expected, then cash receipts will be lower than budgeted. It is important to monitor these assumptions and estimates on a regular basis and to update the cash receipts budget as needed.

Cash Collection Procedures

The company’s cash collection procedures are designed to ensure the timely collection of cash receipts. These procedures include:

- Invoicing customers promptly

- Offering discounts for early payment

- Following up on overdue accounts

- Using a lockbox system

These procedures help to ensure that the company receives its cash receipts as quickly as possible. It is important to note that these procedures should be reviewed and updated on a regular basis to ensure that they are effective.

There are a number of potential risks associated with the cash collection procedures. These risks include:

- Customers may not pay their invoices on time.

- Customers may dispute the amount of their invoices.

- The company’s lockbox system may be compromised.

It is important to be aware of these risks and to take steps to mitigate them.

Cash Flow Analysis

The cash receipts budget can be used to analyze the company’s cash flow. This analysis can help to identify potential cash flow shortfalls or surpluses. If a cash flow shortfall is identified, then the company may need to take steps to increase its cash receipts or reduce its cash expenditures.

There are a number of strategies that the company can use to manage its cash flow. These strategies include:

- Increasing sales

- Improving the collection period for accounts receivable

- Reducing expenses

- Borrowing money

The company should choose the strategies that are most appropriate for its specific situation.

Monitoring and Reporting

The cash receipts budget should be monitored and reported on a regular basis. This monitoring and reporting helps to ensure that the company is on track to achieve its financial goals. The following are some of the key performance indicators (KPIs) that should be monitored:

- Actual cash receipts

- Days sales outstanding (DSO)

- Cash conversion cycle

These KPIs can help to identify trends and problems in the cash collection process. The company should take steps to address any problems that are identified.

Questions and Answers

What are the key components of a cash receipts budget?

Assumptions, estimates, collection procedures, cash flow analysis, and monitoring mechanisms.

How can assumptions and estimates impact the cash receipts budget?

Changes in assumptions and estimates can significantly affect the accuracy of the budget, leading to potential cash flow shortfalls or surpluses.

What is the purpose of monitoring and reporting on the cash receipts budget?

To identify variances from the budget, analyze trends, and make necessary adjustments to ensure financial stability.